Obtain perspectives on several of the major advancements in the global business landscape.

BlackSoil LP Report

Date: 6th May, 2025

Read Time: 12-15min read

BlackSoil Capital Private Limited, through its integrated NBFC (RBI-registered NBFC-ND-SI) and SEBI-registered Category II AIFs, offers a differentiated platform for Limited Partners(LPs) seeking consistent, risk - adjusted, double - digit returns in India’ s alternative credit space.Since acquiring its NBFC in 2016, BlackSoil has scaled its Assets Under Management(AUM) to₹ 2, 213 Cr(₹1, 250 Cr via NBFC and₹ 963 Cr via AIFs) as of FY24, deploying₹ 5, 050 Cr across 205 + transactions

Insurtech Industry Report

Date: 2nd May, 2025

Read Time: 10-15min read

The Insurtech industry, a transformative convergence of insurance and advanced technology, is revolutionizing the USD 5.2 trillion global insurance market by introducing innovative, technology-driven solutions that enhance efficiency, personalization, and accessibility. By leveraging artificial intelligence (AI), machine learning (ML), big data analytics, Internet of Things (IoT), blockchain, and cloud computing, Insurtech companies are disrupting traditional insurance models across the value chain from product design and underwriting to distribution and claims processing.

SaaS Industry Report

Date: 1st May, 2025

Read Time: 10-15min read

The Software as a Service (SaaS) industry continues to reshape global and Indian digital ecosystems, driven by accelerating cloud adoption, AI integration, and the rise of vertical specific solutions.In 2024, the global SaaS market stands at USD 358.3 billion and is projected to reach USD 1.25 trillion by 2034, growing at a CAGR of 13.3 percent.North America maintains leadership with a 46 percent market share, while Asia - Pacific’ s 20 percent share is rapidly expanding.Horizontal SaaS remains dominant, but strong momentum is building in Vertical SaaS(USD 106 billion), AI SaaS(USD 14 billion), and Low - Code platforms(USD 10.5 billion), powered by innovation from players like Salesforce, Adobe, and Microsoft.

Why are Start-ups shutting down

Date: 27th April, 2025

Read Time: 10-15min read

Startups often shut down due to a combination of factors such as lack of market demand, poor product-market fit, or running out of cash. Many founders underestimate the time and resources needed to gain traction, while overestimating customer interest. Mismanagement, team issues, or flawed business models can also lead to failure. Competition, especially in saturated markets, adds pressure, and external factors like economic downturns or changes in regulations can further strain operations. Without sustainable revenue or investor support, startups struggle to survive. Ultimately, a failure to adapt, scale efficiently, or deliver value often seals the fate of many young companies.

Google’s $32B acquisition of Wiz

Date: 24th April, 2025

Read Time: 4-5min read

Google aims to strengthen its cloud security offerings and compete with Amazon Web Services (AWS) and Microsoft Azure by acquiring Wiz, a leading cloud security startup, to capitalize on AI and multicloud trends. The $32 billion price reflects Wiz’s rapid growth, with over $700 million in annual recurring revenue (ARR) and a projected $1 billion, though some analysts question the high 45x–65x revenue multiple.

Indian Gov investment in Space

Date: 21st April, 2025

Read Time: 4-5min read

With ₹1,000 Cr from SIDBI + ₹30.87 Cr in STPI seed funding, the push toward a $44B space economy by 2033 is crazy. Nearly 200 startups, major policy reforms, and global-ready players like AgniKul Cosmos, Skyroot Aerospace, and Pixxel are leading the charge.

Turbine Finance Case Study

Date: 18th April, 2025

Read Time: 8-10min read

Turbine Finance Corp., established in 2022 and headquartered in Santa Monica, California, is a pioneering liquidity platform designed to address the liquidity constraints faced by Limited Partners (LPs) in venture capital (VC) and private equity funds.

KAZAM-Business Break Down

Date: 31st March, 2025

Read Time: 10-15min read

The report analyzes Kazam’s market position, growth strategy, competitive landscape, regulatory risks, financial performance, and fundraising history, offering insights into market expansion, investment opportunities, and strategic direction in the EV sector.

The €1.9 Billion Lie

Date: 3rd February, 2025

Read Time: 2-3min read

Wirecard, once a €24 billion fintech giant and a member of Germany’s prestigious DAX 30, fabricated financial statements to maintain its market value. The company falsely reported €1.9 billion in assets that never existed, deceiving investors and regulators for years.

The Big 'Wait a Minute'

Date: 3rd February, 2025

Read Time: 2-3min read

Goldman Sachs’ risk team saw the warning signs—rising defaults, shaky home prices, and excessive risk exposure. Instead of following the crowd, they bet against the market, using credit default swaps to profit from the inevitable collapse.

Quantitative Finance and Risk Analysis

Date: 2nd February, 2025

Read Time: 1hr read

This project explores Futures, Options, and risk management strategies, building on prior knowledge of market risk analysis and portfolio forecasting. Through a structured deep dive, it covers derivatives fundamentals, the Option Greeks (Delta, Gamma, Theta, Vega, Rho), and dynamic hedging techniques, making complex concepts more accessible.

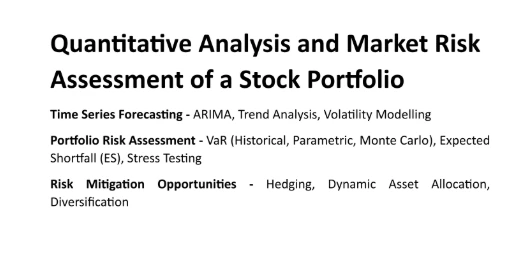

Quantitative Finance and Risk Analysis

Date: 9th January, 2025

Read Time: 1hr read

This project delves into quantitative finance and market risk analysis, focusing on portfolio risk management using historical data from NIFTY 50 constituents. Leveraging advanced financial models like ARIMA for time-series forecasting, GARCH for volatility estimation, and Value at Risk (VaR) & Expected Shortfall (ES) for downside risk quantification, the analysis uncovers market dynamics and risk exposure. Stress testing and scenario analysis further assess vulnerabilities to systemic and idiosyncratic shocks, aligning with IFRS 9 risk frameworks. By integrating stochastic modeling, financial derivatives, and risk-adjusted performance metrics like the Sharpe Ratio, this work bridges data-driven insights with real-world financial strategies, enhancing decision-making in volatile markets.

The Strategic and Financial Brilliance of Tesla and TikTok

Date: 27th December, 2024

Read Time: 7-8min read

Tesla and TikTok represent two sides of the same coin: strategic vision and financial innovation. Tesla’s control over its supply chain and alignment with a global mission offer lessons in sustainability and differentiation. TikTok’s mastery of engagement and creator empowerment showcases the power of community-driven platforms.

Business Strategies from Netflix and Shopify to Outpace Industry Titans

Date: 26th December, 2024

Read Time: 7-8min read

Netflix and Shopify aren’t just businesses, they’re case studies in strategic brilliance. Their innovative use of business models, financial discipline, and focus on customer-centricity have set them apart.

Innovating Revenue Models and Mastering Capital Efficiency

Date: 24th December, 2024

Read Time: 7-8min read

Both Airbnb and Zoho implemented ingenious business strategies that helped them break through the noise and become global leaders in their respective industries. Let’s examine the clever strategies that they used and how they can be applied to your own business.

Nespresso: Brewing Success One Capsule at a Time

Date: 16th December, 2024

Read Time: 5-6min read

Nespresso’s strategy is a textbook example of the razor-and-blades model. While machines are often sold at competitive prices or bundled with promotions, the real profit lies in the proprietary coffee capsules.

Part -1 Understanding Financial terms

Date: 2nd December, 2024

Read Time: 5-6min read

Equity is ownership in a company, typically in the form of shares or stock. Shares are the units into which the company’s equity is divided. Owning shares is the practical representation of equity.

Hosuing market vs Mutual Funds for middle class

Date: 21st October, 2024

Read Time: 2-3min read

For someone earning ₹50,000 per month (around £1,650 PPP), investing in mutual funds or SIPs is generally a better financial decision than purchasing property. With low rental yields and high costs associated with real estate, mutual funds offer higher returns and liquidity, making them more attractive for long-term wealth creation. While mutual funds provide flexibility and potential growth, the emotional bond and sense of security that come with homeownership are significant factors to consider.

Zerodha: A Data-Driven Disruption in the Brokerage Market

Date: 29th September, 2024

Read Time: 10-12min read

In the bustling landscape of Indian finance, where legacy brokerages have traditionally dominated through lavish advertising and extensive marketing budgets, Zerodha emerged as a beacon of innovation. Founded in 2010 by brothers Nithin and Nikhil Kamath

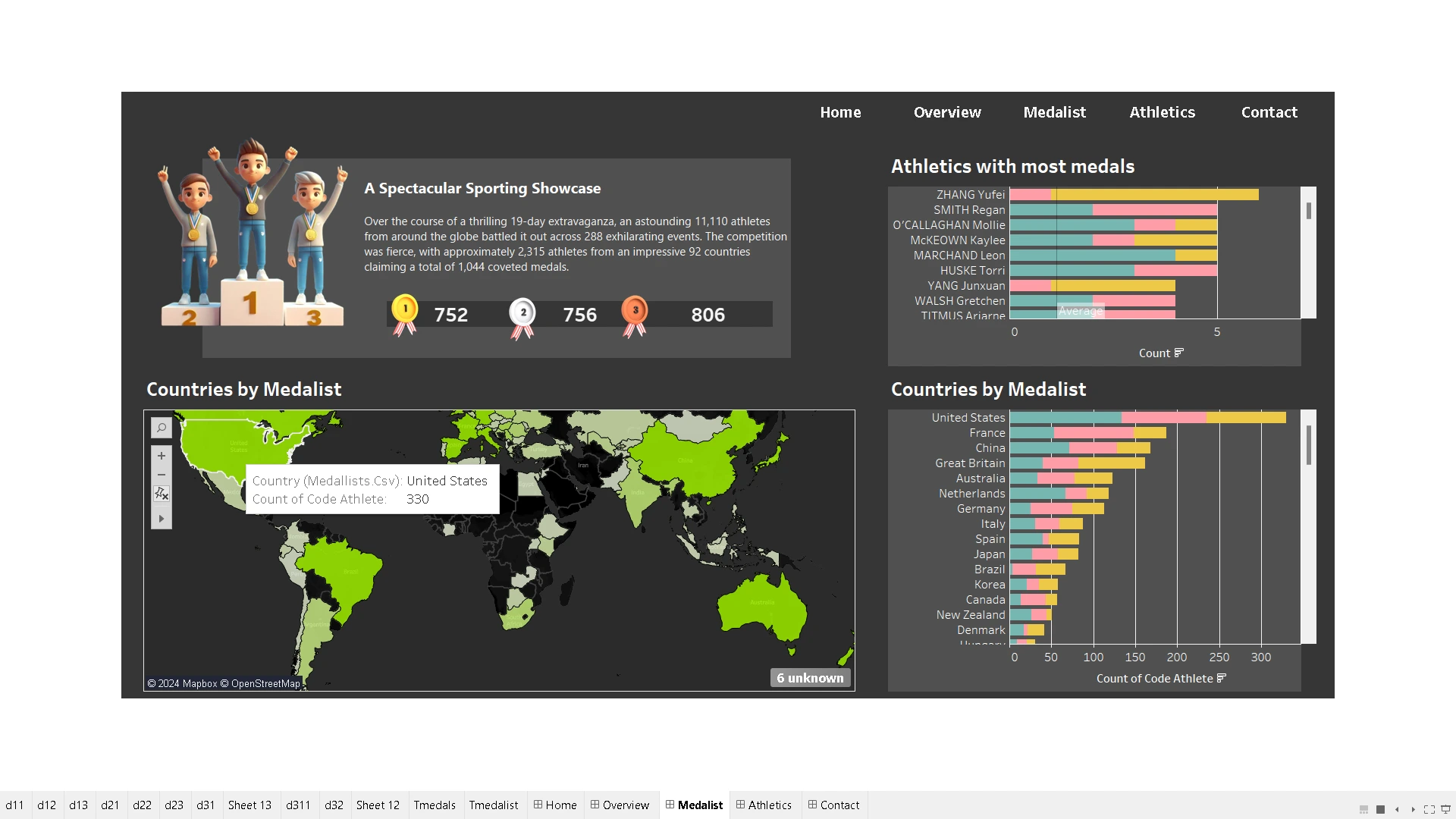

Paris olympics 2024 Data Insights in Tableau dashboard

Date: 19th September, 2024

Read Time: 10-12min read

What do you do when you’re not competing in the Olympics? Well, you create a Tableau dashboard to analyze the real champions! I just had a blast brushing up my dashboard design skills while building an interactive Olympics 2024 insights dashboard. From who’ s bagging the most medal to how athletes are stacking up by country, discipline, and gender.Wanna geek out on the numbers and reveal the insights ?

Crystal Ball for Businesses: Unlocking Future Consumer Behavior for Unmatched Growth

Date: 16th June, 2024

Read Time: 5-7min read

In this fast-paced and ever-evolving business landscape, we have already understood the importance of limitless technology and best operations. But staying ahead of the competition requires more than just that. Imagine having a crystal ball that reveals the future behaviours and preferences of your customers.

Understanding the Decline in Startup Valuations in India

Date: 10th June, 2023

Read Time: 8min-10min read

The Indian startup ecosystem has been on a tear in recent years, the tide seems to be turning, as venture capital (VC) firms are becoming more cautious about valuations.

NVIDIA's Market Cap Reaches $970 Billion

Date: 29th May, 2023

Read Time: 3min-5min read

Nvidia, the world's leading provider of GPUs, has reached a market capitalization of $970 billion, solidifying its position as a global tech powerhouse.

The Gig Economy: A New Way to Work

Date: 28th May, 2023

Read Time: 3min-5min read

The gig economy is revolutionizing the way we work, offering exciting opportunities for independent contractors to engage in short-term projects through online platforms. Writers, designers, drivers, and delivery workers are just a few examples of professionals thriving in this dynamic landscape.

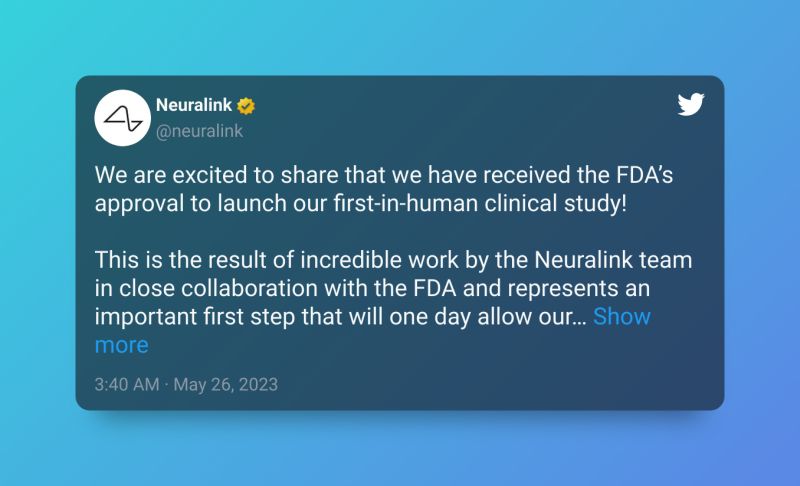

Neuralink: The Future of Humankind?

Date: 26th May, 2023

Read Time: 2min-4min read

Elon Musk's Neuralink company has been making headlines for its groundbreaking development of brain-implant technology. The company has already achieved successful implantations in pigs and monkeys, and now it's gearing up for human trials!

Have you heard of Neeva?

Date: 25th May, 2023

Read Time: 2min-4min read

It's a 2019-founded company that aimed to challenge Google with an ad-free search engine, using AI for more relevant and accurate results. Founded by ex-Googlers Sridhar Ramaswamy and Vivek Raghunathan, Neeva prioritized user control and privacy.

Understanding Changing Consumer Behaviour

Date: 22nd May, 2023

Read Time: 6min-8min read

Consumer behaviour has undergone significant transformations throughout history. From price-consciousness to an emphasis on quality and sustainability, consumers have become more discerning in recent years. This article explores the important revolutions that shaped consumer behaviour, examines current changes, and speculates the future.

Stay tuned for a fresh perspective on these fields!